AI in HR:

Leap over hiring hurdles and get straight to the right candidates

Get on track with talent technology

Today’s talent acquisition teams are grappling with an increasingly complex and rapidly changing market.

In the face of a prolonged time-to-hire cycle that is averaging 42 days, the current recruitment landscape presents numerous hurdles that hinder swift and precise hiring – from sourcing brand new skills, to higher candidate rejection rates, and increased competition for top talent.

Right now, the importance of finding a suitable candidate fit cannot be overstated. Both employers and job seekers benefit immensely from targeted candidate matches that are fuelled by skills and expertise.

Enter: Artificial Intelligence (AI).

AI can transform the approach to job hunting and recruitment. Harnessing its power can provide a strategic advantage, enabling companies to pivot towards agility, data-driven decision-making, and enhanced efficiency.

While leveraging this technology’s diverse capabilities to overcome barriers requires thought and planning, once successfully done, it can streamline recruitment efforts for faster, fairer outcomes.

This article delves into strategies for navigating this exciting new technology in its many forms. It addresses the hiring hurdles facing TA teams right now and explores how AI-driven talent tools can make all the difference in getting you straight to the right candidates.

Feeling the ambition to hire with AI?

Looking to integrate AI into your business and start overcoming the hiring hurdles in your organization? Here are some tips to help embrace the power of AI:

– Invest in AI-powered platforms tailored to your organizational needs, objectives and values.

– Foster collaboration between HR, IT, and AI specialists, and incorporate feedback into the strategy.

– Develop clear guidelines for AI implementation in recruitment processes.

– Provide comprehensive training on AI tools and methodologies.

– Cultivate a culture of learning, innovation, experimentation, and adaptability of AI applications.

– Emphasize data privacy and ethical considerations in AI usage.

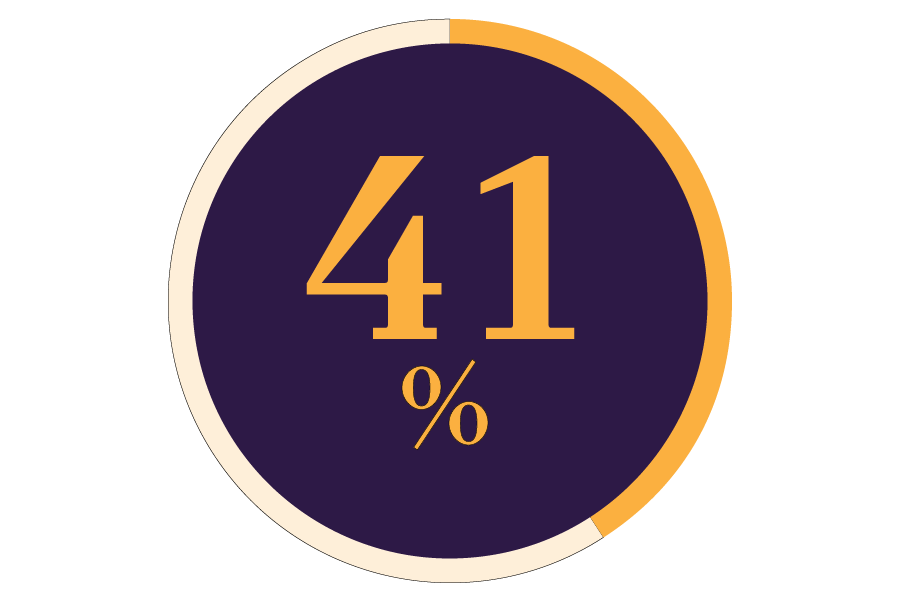

Talent teams shared with us how they are gearing up to use AI

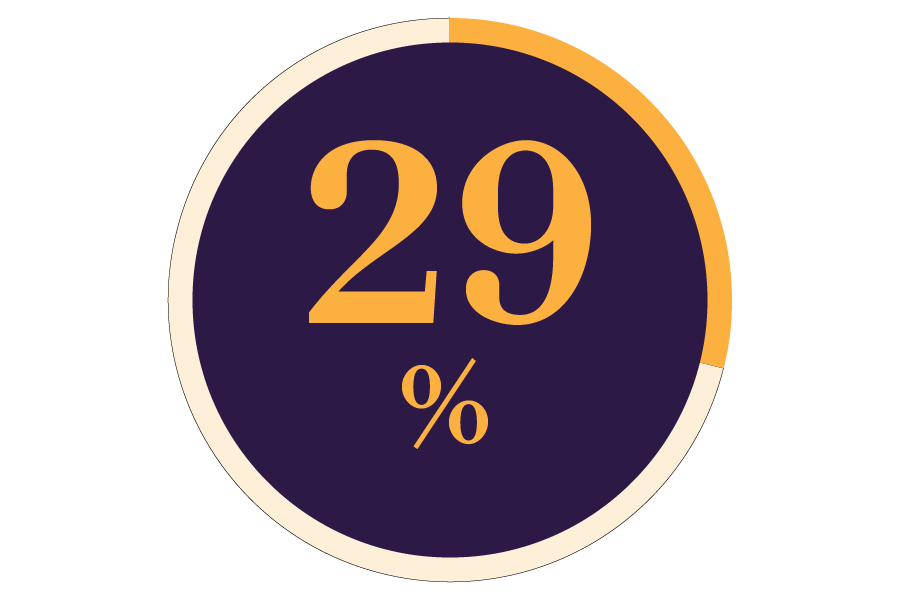

Said customized outreach emails could be made more compelling by AI

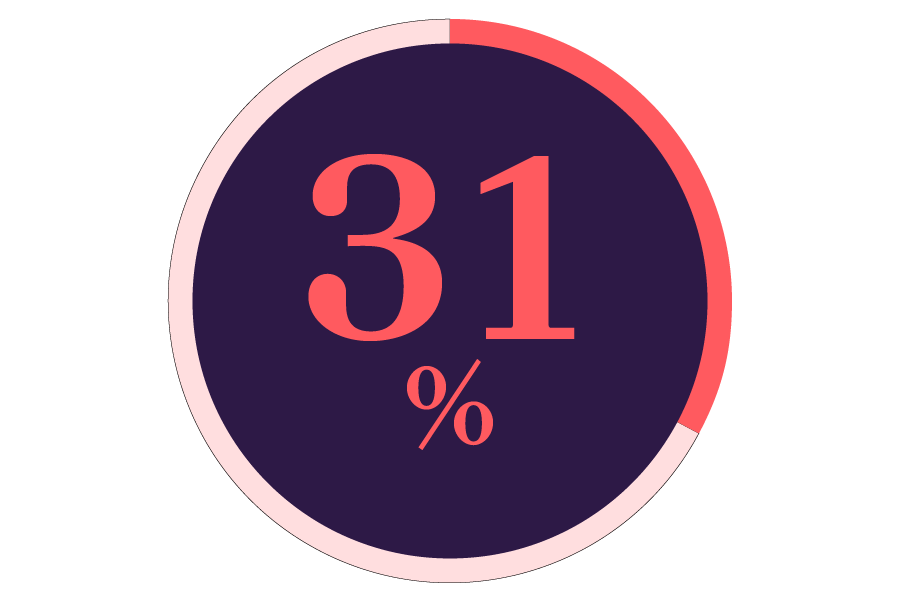

Said targeted job descriptions could be made creative with the use of AI

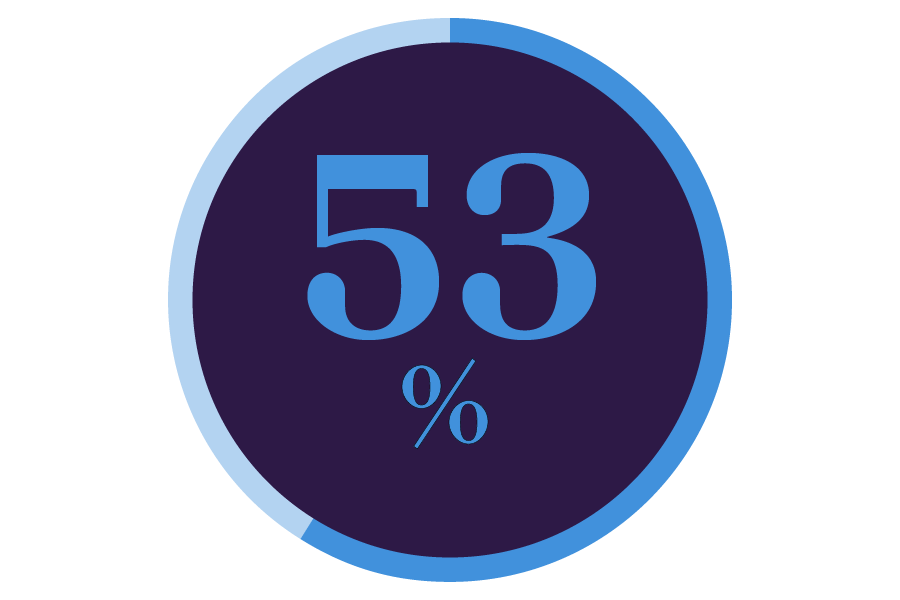

Said automating interview notes with AI could help create concise summaries

Said AI can strengthen hiring by creating faster short lists of candidates

*Results from four AI LinkedIn polls during April 2024

Overcoming your hurdles: common hiring obstacles and how AI can help

Examining your current hiring process from a bird’s eye view can pinpoint the areas that are consuming the most time and creating an unnecessarily long candidate journey.

It could be that Sourcers are multi-tasking multiple steps upfront with a candidate, or that recruiters are targeting the wrong individuals. Whatever is creating this friction, it’s vital to figure out what is stopping your talent team from reaching their end goals.

Talent Hurdle #1

Misuse of valuable time

Many TA departments are spending hours of their precious time and resource on admin-intensive jobs, such as interview scheduling and transcription, when they could be focusing on more valuable areas like improving the candidate experience and creating meaningful connections with applicants.

AI Action

Give small processes to AI

Tech-powered interview transcription and summarization capabilities allow recruiters to gather information quickly and store data effectively. And by automatically scheduling candidate interviews using agile and dynamic AI – problem solving will naturally improve and can help enrich the recruiter and candidate relationship. Taking these tasks away from recruiters ultimately allows them to interview more people per role, and in more depth.

Talent Hurdle #2

Disjointed candidate experiences

From job posting to acceptance, this multi-step journey requires careful assessment. A target audience need to feel engaged with your brand. They want to engage in a conversation in their language, using digital channels to ensure there is a cohesive experience throughout. But recruiters could benefit from more time focusing on their tasks while AI handles creation of a more engaging and consistent process.

AI Action

Elevate their journey with AI

AI can be used to create more compelling job descriptions, as well as more personalized and relevant outreach emails. Using chatbots and other AI-powered communication tools will offer candidates an experience that is highly personalized to them. This interactive and multi-channel candidate communication experience will benefit hiring prospects and require less manual effort from recruiters.

Talent Hurdle #3

High numbers of applicants

Providing every candidate with a great experience can be challenging, especially when recruiter resource is scarce and applicant volumes are overwhelmingly high in some cases. Without the right support and consistent communication, candidates could become disillusioned and drop out of the process to find other opportunities.

AI Action

Let AI tailor your talent pool

Skills mapping tools driven by AI create a more accurate skills fit between open roles and candidates. It means recruiters spend less time on the wrong individuals, providing a clearer path to candidates who are truly fit for the job. With a smaller but significantly more relevant talent pool to work from, recruiters can focus their energy on engaging the right people, effectively.

Talent Hurdle #4

Missing out on strong candidates

Many of today’s TA teams don’t have the ability to create skills profiles and global skills maps – or if they do there might be constraints around the processes here. This means that more diverse and underrepresented candidate groups, or remote-based candidates are often overlooked. As a result, the talent pool for open roles may be considerably limited.

AI Action

Cast your net wider with AI

As well as removing the wrong candidates from your hiring process, AI-powered skills mapping tools can also help to widen the original candidate search from which to create your finessed shortlist. AI technology can improve access to skills insights and pinpoint skilled individuals (both local and global) who may never have been seen or considered before, helping to create a more diverse talent pool.

Talent Hurdle #5

HR’s internal performance and talent management needs a boost

Is your helpdesk not functioning the way it was intended? Service centre functions could use an over haul? Are you finding costs are getting sunk into internal tech tools that don’t integrate and make sense for the business?

AI Action

Enhance your performance management with AI

Utilizing AI can help teams to run their internal processes more smoothly and uncovers areas of opportunity for internal mobility, workshopping, brainstorming etc. It can also identify areas where employees can be upskilled to perform new tasks.

Staying on course with ethical and compliant AI

While pinpointing ways in which AI can refine your hiring process is important, it’s also vital to ensure your AI solutions are rooted in compliance.

At the moment, there are many legislations and partnerships underway to formalize the process for leveraging AI as it finds its place in our world. With a near-daily influx of new AI-driven tools, staying up to date on these ever-shifting AI trends and legalities is crucial. But it can also be overwhelming.

So, where to start?

As a first stop in hiring safely with AI, consider how you’re using it. Do you need talent development in the AI space to enhance your workforce’s AI and talent tech capabilities, would you like machine learning and AI to support you in finding hires, or are you on the hunt for talent technology? Then understand what is happening in the AI safety regulations within your region. Will key announcements in global legislation impact your plans to adopt or leverage AI?

You may also consider working with an expert technology advisory partner with hands-on experience in a wide variety of AI tools. Organizations, like AMS, specialize in implementing and optimizing AI for businesses – from setting clear business goals that AI can support with, to upskilling internal teams and ensure readiness for AI adoption.

“While AI in recruiting has enormous potential, teams should validate the recommendations and work with their vendor partners, like AMS, to make sure these systems are trained on relevant data – and make sure real-world recruiters are involved.”

– Josh Bersin, The Josh Bersin Company

Questions to ask to avoid improper use of AI:

– Who has audited this tool or AI model and what were their findings?

– What data does this tool require to operate and does that data pose a risk?

– Are data points too limited? Is the system transparent?

– What processing is happening outside of the AI? Is other technology being used anywhere? Has it been tested?

– Are my candidates using AI to apply? How is this impacting hiring as well?

AI in talent: achieved! What’s next?

You’ve set out on this AI course, witnessed the transformative power it brings to your hiring game. Checked that box, conquered those obstacles. But let’s pause for a moment: did you truly reach the right candidates?

AI in talent acquisition isn’t a one-and-done deal; it’s an ongoing adventure that will require innovative and adaptive mindsets. To thrive, you’ll need to embrace change with the resilience and agility of a talent trailblazer. Because let’s face it, the employee of tomorrow isn’t just skilled—they’re open-minded, and ready to unleash AI’s true potential.

In this tech-forward hiring game, data reigns supreme. AI’s expertise hinges on its access to the key information. Without a steady stream of insights, trends, and patterns, its potential is limited and so is your ability to keep up with the talent you need.

The future of talent success lies in the willingness to adapt to tech.

The future of recruitment will present novel capabilities – such as around audio and video – that are likely to play a role in your hiring.

Prepare for big change ahead. AI demands a reimagining of your operational playbook and an overhaul to your team’s skills. It’s not just about compliance; it’s about unleashing the full potential of your tech-savvy workforce.

“By leveraging the opportunities tech-enabled RPO will bring to automation, administrative tasks and predictive insights, it allows people to do what they do best – transforming the candidate experience.”

Nikki Hall, Chief People Officer, AMS

Ready to start overcoming your hiring obstacles with AI?

Need help getting started with Artificial Intelligence in Talent Acquisition?